Commerce7 has welcomed 400+ wineries since acquiring WineDirect's SaaS division. Ready to migrate?

Mobile Payments: What Are They and How Do They Benefit Your Business?

Karen Urquhart 6 min

Jun 18, 2022Since the first commercial prototype in 1973, mobile phones have continued to see improvements to their functionality, and have become an integral part of our everyday lives. From communicating with friends and family to browsing the web and even tracking our steps, the uses for smartphones seemed limitless and continued to expand to meet new demands.

Eventually, mobile phones dove into the world of payments, and the usage of digital payment methods like mobile wallets have been growing rapidly ever since. In fact, the global market for mobile payments is expected to reach $373.1 billion by 2028, which - to be frank, is unsurprising. We live in a world where instant gratification ranks supreme, and there isn’t a more convenient form of payment for motivated shoppers than a mobile wallet.

Often regarded as the fastest and simplest way to checkout, it’s easy to see why the number of mobile wallet users jumped from 900 million to 1.48 billion in 2020. The way we shop is changing. Consumers are continuing to move away from the traditional wallet and opting for more user-friendly payment options; and that is exactly what mobile payments provide.

Mobile Payments & Mobile Wallets: What are they and how do they work?

Mobile Payments

A mobile payment is a general term that refers to the action of purchasing a product or service from a mobile device such as a smartphone, smart watch or tablet. Instead of paying with cash, cheques, or credit cards, consumers would instead use their mobile device to pay for a wide range of products in person or online.

Mobile Wallets

A mobile wallet is a digital version of your traditional wallet that lives in your mobile device. You can add your credit or debit card information that is then stored securely and readily available at the touch of a button. Mobile wallets give you the freedom to pay for goods and services without the need for a physical wallet in a fast, convenient and secure way.

How do they work?

In order to use mobile payments and make a purchase with a mobile wallet you need to download the mobile wallet of your choice onto your smart device. These can include ApplePay, SamsungPay, WePay and AliPay to name a few. Once you have access to the app, you can add and store your card information including credit cards, debit cards, and even loyalty cards.

When you want to make a purchase, you can use your mobile wallet in person or online for a seamless checkout experience.

For in-person transactions, near field communication (NFC) is the main technology used to power contactless payments, which is the same technology that lets you use contactless payments to pay with a physical card. Similarly to Bluetooth, NFC supports the digital transfer of data; however, NFC requires closer device proximity and has greater built in security. To make a purchase, you would open your payment app, select your preferred card and provide your authorization (touch ID, face ID or password) for the transaction. Once authorized, you would simply hold your mobile device over or near a contactless reader that then captures the relevant payment information.

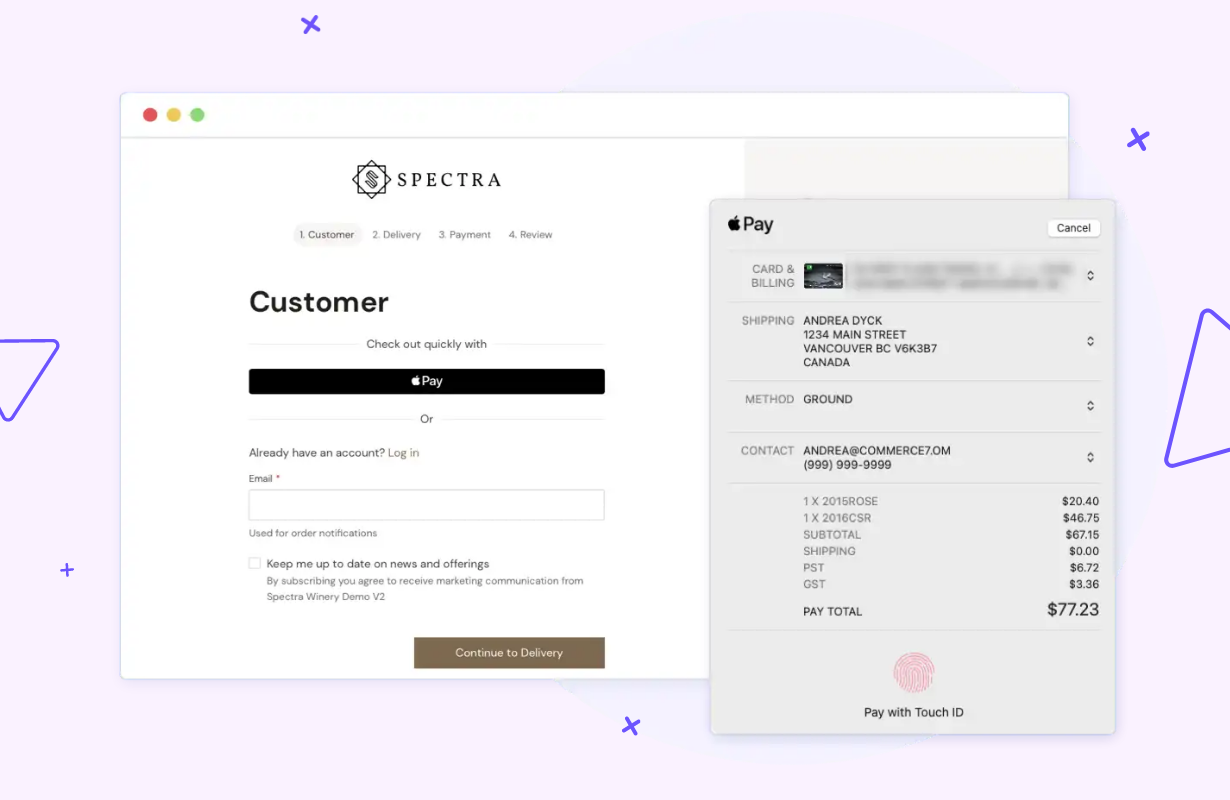

Unlike in-person purchases, online shopping often requires you to fill out lengthy checkout forms everytime you want to make a purchase, which can get a bit monotonous. Using a mobile wallet simplifies that process by automatically filling in that information for you! If you are making a purchase from a participating e-commerce merchant that offers mobile payment options, you would simply select your preferred mobile wallet as your payment method, select the card you would like to use and provide authorization to complete your order.

How Do Mobile Payments Benefit Your Business?

It improves the customer experience and increases your sales

- Mobile payments are far and away the most convenient way for your customers to pay. Whether in person or online, allowing customers to use their mobile wallets eliminates the hassle of carrying around a physical wallet with all of their cash and cards, or fumbling to find their card to enter into an online checkout form.

- Have you ever opted not to buy an item due to the length of the checkout line? Yeah, me too! In-person mobile payments can help eliminate long queues during your busy season(s), which directly contributes to customer satisfaction. As a result, your brand will become synonymous with quality service and your business will see a positive impact on sales (which is a great tradeoff if you ask me!).

- Why make customers do more work to purchase from your winery, when they can do less? Accepting mobile payments on your e-commerce site greatly reduces checkout friction and makes for a hassle free buying experience.

It minimizes online cart abandonment and boosts conversions

- The checkout page holds the greatest risk of losing sales, but adding convenience and improving speed at checkout are the keys to minimizing abandoned carts and increasing online conversions.

- Mobile payments make it quick and easy for customers to buy your product, and lets you finalize a transaction in seconds. There is little to no time for a consumer to second guess their purchasing decision, leading to an increase in sales.

It’s more secure and builds trust with your customers

- When a customer checks out with a digital wallet, a unique series of randomly generated numbers, also referred to as a token, is assigned to their card.

- Unlike a credit card number, a token is more secure because it hides your customers actual credit card information and can only be used with a unique, encrypted code that is applied to each individual transaction.

- This technology helps to reduce fraud as it eliminates the risk of having credit or debit numbers stolen, which instills a sense of confidence and trust in your customers, as they know they are buying from a brand who values their security.

Make the Most of Mobile Payments on Commerce7

Take advantage of mobile payments as a Commerce7 customer. All C7 customers using Commerce7 Payments as their gateway can generate more revenue and create better shopping experiences by offering one-click checkout and one-click club sign up through mobile wallets on Commerce7. Accepted mobile wallets include: Apple Pay, Google Pay, Alipay, WeChat Pay, Samsung Pay, Microsoft Pay, among other mobile payment options.

You can trust that as the world of payments evolves, your direct to consumer sales platform will keep pace and continue to roll out new and innovative payment solutions.

Ready to embrace a new wave of payment technology? Get started with Commerce7 Payments today.

Ready to create better shopping experiences?

See Commerce7 firsthand by scheduling a demo with our team.

Schedule a Demo